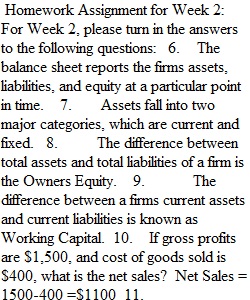

Q BUSN 5200 Homework Assignment for Week 2: For Week 2, please turn in the answers to the following questions: 1. The __________________ reports the firms assets, liabilities, and equity at a particular point in time. 2. Assets fall into two major categories, which are ________________ and ______________. 3. The difference between total assets and total liabilities of a firm is the ____________________________. 4. The difference between a firms current assets and current liabilities is known as ___________________. 5. If gross profits are $1,500, and cost of goods sold is $400, what is the net sales? 6. What are the three major divisions in the accounting field and what are the main functions of each? 7. The portion of a company’s profits that are kept by the company rather than distributed to stockholders as cash dividends is known as ______________________. 8. If the current account balances are: Cash = 5,000 Inventory = 7,500 Accounts Payable = 10,000 Long Term debt = 25,000 Retained Earnings = 15,000 Calculate the current liabilities: 9. Which financial statement reports the amounts of cash that the firm generated and distributed during a particular time period? 10. If the current account balances are: Cash = 5,000 Accounts Receivable = $500 Accounts Payable = $750 Common Equity = $2,000 Fixed Assets = 1,500 Calculate current assets 11. Based on the financial information below, prepare an income statement and a balance sheet for Webster company for the year ended December 31, 2020 in the proper format. Unless otherwise indicated, assume all information below is either for the year 2020 or as of December 31, 2020. Accounts receivable………………………………….. $9,000 Accumulated depreciation…………………………… $12,000 Cost of goods sold…………………………………… $4,000 Income tax expense………………………………….. $5,000 Cash………………………………………………….. $ 5,000 Sales………………………………………………….. $55,000 Equipment (gross)……………………………………. $40,000 Selling, general, & administrative expenses…………. $5,000 Common stock (1,000 shares)………………………... $10,000 Accounts payable……………………………………. $15,000 Retained earnings……………………………………. $9,500 Interest expense……………………………………… $200 Inventory…………………………………………….. $18,000 Long-term debt………………………………………. $ 25,500 Dividends declared and paid………………………… $800 12. If earnings before taxes (EBT) are 275,000, net sales (all on credit) are 315,000, dividends are 25,000 and net income is 225,000, what is the tax expense. 13. What does EBITDA stand for? 14. If net sales are 55,000, accounts receivable is 2,000, depreciation expense is 5,000 and cost of goods sold is 4,000, calculate the gross profit: 15. Roberts Company year end balance sheet lists current assets of 500,000, fixed assets of 250,000, current liabilities of 316,600 and long term debt of 214,500. Calculate Roberts Company total shareholders equity.

View Related Questions